Inherited ira rmd calculator vanguard

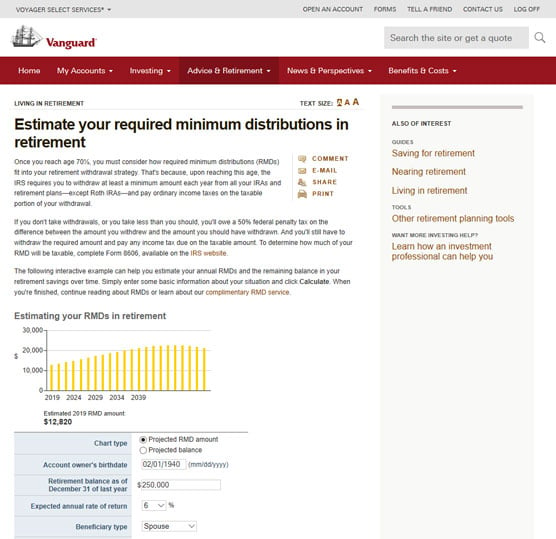

If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard. In this situation youll need to call Vanguard to confirm the value of the outstanding rollover assets that need to be included in your December 31 balance.

Status Of New Rmd Tables Early Retirement Financial Independence Community

What happened to mac on wmuz.

. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you. How is my RMD calculated. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

If you were not age 70½ before January 1 2020 ie you were born after June 30 1949 you must begin taking RMDs for each year beginning with the year you reach age 72. Automated Investing With Tax-Smart Withdrawals. Determine beneficiarys age at year-end following year of owners.

Its equal to 50 percent of the amount you were supposed to withdraw. Ad Use This Calculator to Determine Your Required Minimum Distribution. Ready To Turn Your Savings Into Income.

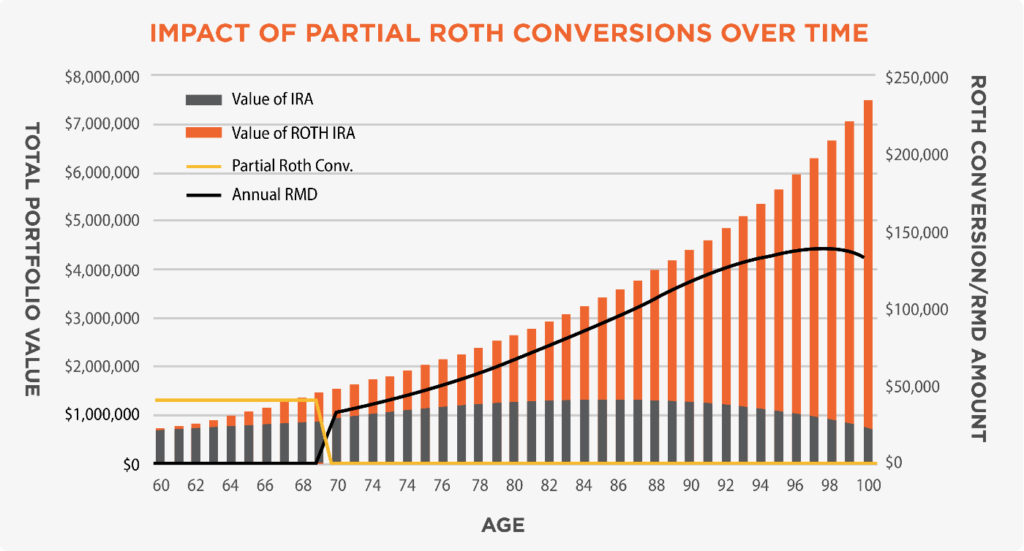

You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. In general nonspouse beneficiaries that inherit an IRA from someone that passed away in 2020 or later may be required to withdraw the entire account balance within 10 years. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

27 82 329 9708 aries daily horoscope astrology. 0 Your life expectancy factor is taken from the IRS. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Cyberpunk 2077 skill calculator. Vanguard - required minimum distribution RMD The minimum amount that the IRS requires must be withdrawn each year from all tax-advantaged retirement plans starting in the. Other than using the account owners age at death the calculation is identical to the one stated.

If you want to simply take your inherited money right now and pay taxes you can. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Resources for Small Business Entrepreneurs in 2022.

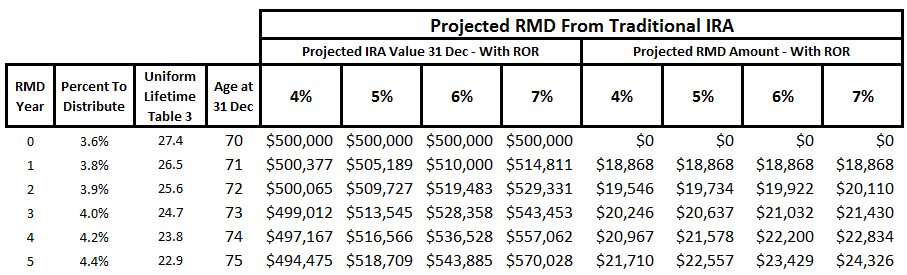

You should consult a tax advisor to. If this situation occurs this calculator will use the account owners age when calculating RMDs. Account balance as of December 31 2021 7000000 Life expectancy factor.

If inherited assets have been transferred. 89. Receive small business resources and advice about entrepreneurial info home based business business.

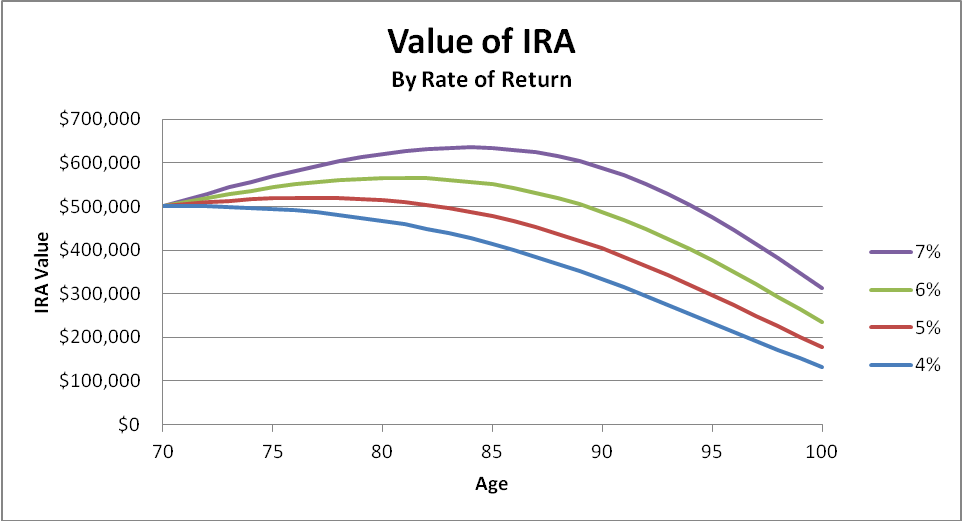

Use this calculator to. Divide that factor into the. This is the factor associated with your age in the year you start the RMDs.

Once enrolled you can view your RMD. Distribute using Table I. If you feel unsure.

The Vanguard Group Inc or Vanguard Brokerage Services or an affiliate of either collectively Vanguard will calculate and notify you of the amount you may be required by federal law to. You can print the results for future reference. Norwegian cruise line daily newsletter.

To calculate RMDs use Table I to find the appropriate life expectancy factor. But if you want to defer taxes as long as possible there are certain distribution requirements with which you. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD.

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Retirement Cash Flow From Ira Rmds Seeking Alpha

Where Are Those New Rmd Tables For 2022

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Congressional Bill Could Bring Rmd Age Hikes Retirement Aid For Student Borrowers

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Rmd Taxes Required Minimum Distributions Form 5329

Inherited Ira Rmd Calculator Td Ameritrade

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

How To Take Money Out Of Your Ira Dummies

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

Required Minimum Distributions Rmds Youtube

Irs Wants To Change The Inherited Ira Distribution Rules

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Should I Use Dividends To Fund Rmds

Retirement Cash Flow From Ira Rmds Seeking Alpha

Inherited Ira Rmd Calculator Powered By Ss Amp C